Do the historical returns on Real Estate investments justify the confidence so many investors have in them?

The ownership of land is deeply rooted in the minds of people all over the globe. Land is seen as the one investment that is solid and permanent, and for most people it is the single largest investment they would make during their entire lives. The American Dream has long included the ownership of Real Estate, but when you move beyond this natural impulse to own property, and look at Real Estate purely from an investment opportunity, how does the picture change? Have the historical returns on Real Estate Investment measured up to the confidence it has received.

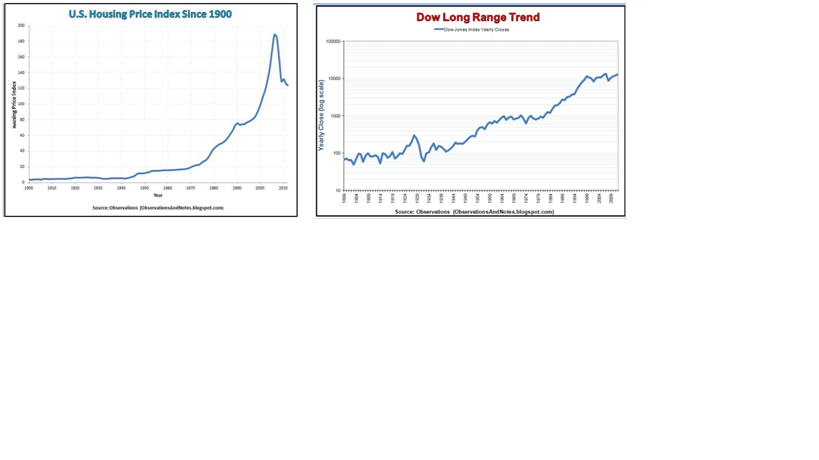

The answer is not clear. The annual average Rate of Return (ROR) on Real Estate between the years 1900-2012 (Including the housing bubble of 2008) was around 7.2% as shown in the US housing price index chart below. During the same period, the average rate of inflation was around 3.2%, so it was obviously a better investment to buy Real Estate than to keep cash below the mattress. (The Real Estate average ROR was around 7.6% between 1900-2008). The rate of return for the Dow Jones Industrial Average (DJIA) for the same period was around 9.2% as shown in the Dow Long Range Trend chart below. These figures would suggest that Real Estate investments closely track the Stock Market returns.

Real Estate Investors might want to make the claim that land ownership and its value as an investment predates the Stock Market by thousands of years. This is true; however the new global economy has created a whole new playing field, and Return on Investment (ROI) must be determined within the framework of a rapidly changing, internet age, global economy. It is all well and good to study the past, but in investment strategy, the past only offers clues and does not provide clear predictions for future investments.

A look at the historical ROI for Real Estate investments shows that they tend to be more stable and less likely to spike up and down in erratic and unpredictable fashion like the Stock Market (with the exception of the housing bubble of 2008). Many financial advisors recommend the inclusion of 10%-20% in Real Estate investment in any portfolio as a hedge against market fluctuations. Real Estate investments, however, tend to have high transaction costs and require large sums of cash for down payments. They also carry maintenance fees and other auxiliary expenses and are not easily liquidated.

These negative factors have led to the popularity of investments in Real Estate through Real Estate Investment Trusts (REITs). REITs are mutual funds of Real Estate which enable investors to invest in Real Estate without the complications of high transaction costs or property expenses.

19 Responses

I prefer investing in real estate over stocks, simply because it’s more interesting to me… I believe, although it’s important, that life should not necessarily be about what return you’re going to get, but how much are you going to enjoy the time, energy, and thoughts you’re going to be spending on your investments. For me, even if stocks were to have a larger return than real estate, I believe there is more risk if you aren’t knowledgeable in how the stock market works, or if you get a broker who isn’t experienced enough. Real estate can go down, but it seems to be a lot more predictable than stocks, and if I’m going to do something, I’m going to do what I enjoy, I’m going to do what I’m actually interested in, and I’m going to do what I’m more knowledgeable in. If I have any say in the matter, my husband and I will never invest in the stock market, lol!

Based on your charts, if you are in it for the long haul, either can be a good investment. It’s all about selling at the right time. And you’re right about the other/extra costs and higher level of investment that is almost always involved with real estate investing (unless you’re buying in Detroit right now). That’s the only reason my husband and I currently don’t own anything 😉

Great comment! I couldn’t sum it up better!

It is in fact about how much you want to do something in life, and you are COMPLETELY correct about the stock market vs. Real estate. Real estate investment definitely is more predictable and in the long run better and safer.

I now know who to talk to when I am dealing with these kinds of questions.

Thanks Lisha!

I am firm believer in real estate investment. There is still demand of real estate properties. As the population grows, more and more customers are looking decent property.

You are right! Great job on summing it up in short.

I would think that a person wouldn’t want just one or the other. Diversifying is the name of the game, and you don’t want to put all your eggs in one basket – just as with investing in the stock market you don’t want to buy just one kind of stock. Put some in real estate, some in stocks..watch it (hopefully) grow!

I hear you, but the question is, what happens if you lose money in both, then you won’t have a last resort for investment.

Thanks again Brock for stopping by!

If you can afford it, do both. Both real estate and the stock market suffered a lot during the recession so there’s always risk involved, but things are coming back long term. Real estate isn’t for everyone though and is a big commitment, whereas you can invest even $10. I think it’s always good to diversify.

I think you are completely correct. This is a great analysis and you give great support.

People should do what they feel most comfortable with. It’s your money, and whatever happens, it’s going to be you who gains or loses. Be smart no matter where you put your money…

I completely concur.

I don’t consider a primary residence as an investment, because it’s not by the very nature of it. I own a home but will likely never want to invest in real estate in the true sense of the word – outside of my primary residence. I don’t know that the Canadian real estate market will ever be worth investing in.

I would think that anywhere you put your money would be considered an investment… that’s what an investment is… a place you put your money… However, some things you get a return on and other things you don’t 😉

Great point.

I think of a place to live as a consumption item. You can either rent or buy, but you always need a place to live. Personally, I try to minimize my consumption (mortgage or rent) so that I have more to invest in real estate, stocks & bonds.

Sounds interesting. I am sure that at one point in the metropolitan area it will, but in Northern Canada, for sure not.

I think it depends whether you’re more of a risk taker or a risk averse. Real estate is more stable, so even thought the ROR isn’t that high, at least it’s unlikely that you’re going to lose money in the long run unlike if you invest in stock market.

Marvelous content, thanks for sharing !!

This post seem extremely nice.